child tax credit for december 2021 how much

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. For 2021 eligible parents or guardians can receive up to 3600 for each child who.

Final Check Child Tax Credit Payment For December Youtube

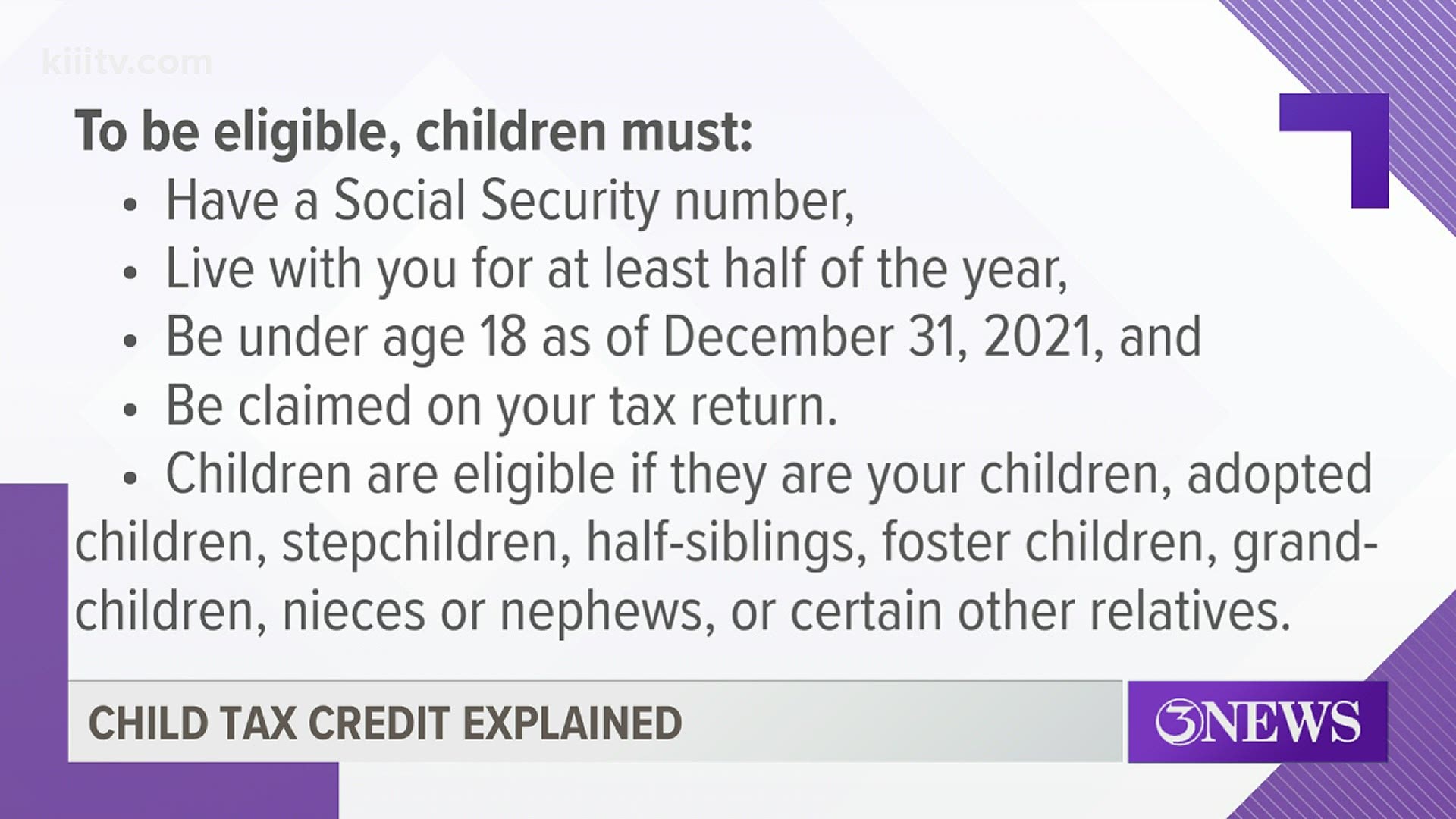

The child has a Social Security number even if you dont have one You do not.

. For children aged 6 to 17. 3600 for children ages 5 and under at the end of 2021. The enhanced child tax credit increased from 2000 to 3000 per child 17 and under and 3600 for kids under age six for the 2021 tax year.

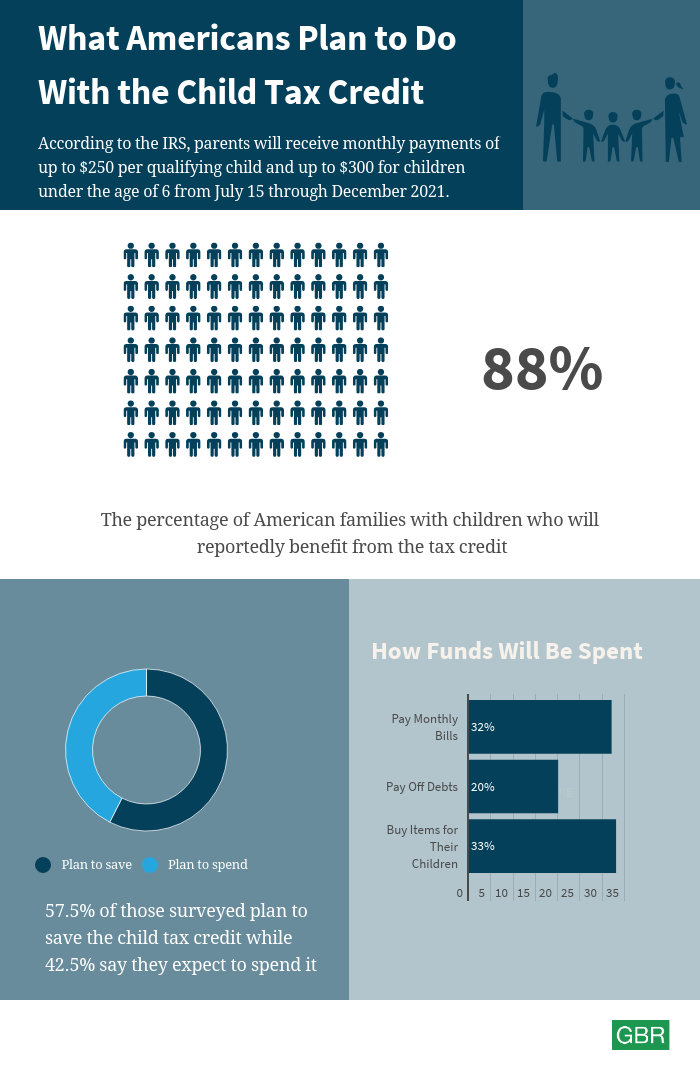

Those who are eligible will. Beginning in July 2021 payments are to be. It helped roughly 60 million children and helped cut child.

Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their joint-filing parents earn less than. We provide guidance at critical junctures in your personal and professional life. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and.

By William Leborgne Published 08012022. If youre wondering how much is the child tax credit for 2021 it was 3600 for every dependent child under the age of 6 and 3000 for every dependent child over the age of. The Child Tax Credit increased from 2000 to up to 3600 for each.

Families could be eligible to. And 3000 for children ages 6. Child Tax Credit 2021 vs 2022 The 2021 credit increased to 3600 from 2000 in 2021 and you receive a credit for each child under six years of age.

The child lived with you more than half the time in 2021 and you can claim them as a dependent on your taxes. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. Additionally the trillion-dollar stimulus bill gave the Internal.

If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 3600 to 3600 for each qualifying child.

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Hot off the press - the Child Tax Credit 2021 is already being distributed to people who qualify. The current credit is worth 3600 for each child under six and 3000 for those between six and seventeen.

Under the new law the credit is fully refundable meaning families who owe little or no federal tax will get a check for the full amount. Under the American Rescue Plan the Child Tax Credit was expanded in several ways for tax year 2021. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. For 2021 the maximum amount of the credit is 3600 per qualifying child. The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families.

112500 if you are. Thats up to 7200 for twins This is on top of payments for any other qualified child. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17.

What Families Need To Know About The Ctc In 2022 Clasp

Congress Votes To Increase Child Tax Credit Bring More Families Out Of Poverty Youtube

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

What You Need To Know About The Expanded Child Tax Credit For 2021

How To Get Up To 3 600 Child Tax Credit Now Michael Ryan Money

Most Americans Plan To Put Advanced Child Tax Credit Into Savings Gobankingrates

Child Tax Credit Eligibility Kiiitv Com

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kokh

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

What Is The Child Tax Credit Tax Policy Center

How To Get The Child Tax Credit Massachusetts Jobs With Justice

Enhancing Child Tax Credits Support Of New Jersey S Neediest Families New Jersey State Policy Lab

Child Tax Credit December How To Still Get 1 800 Per Kid Before 2022 Marca