vermont income tax rate 2020

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate.

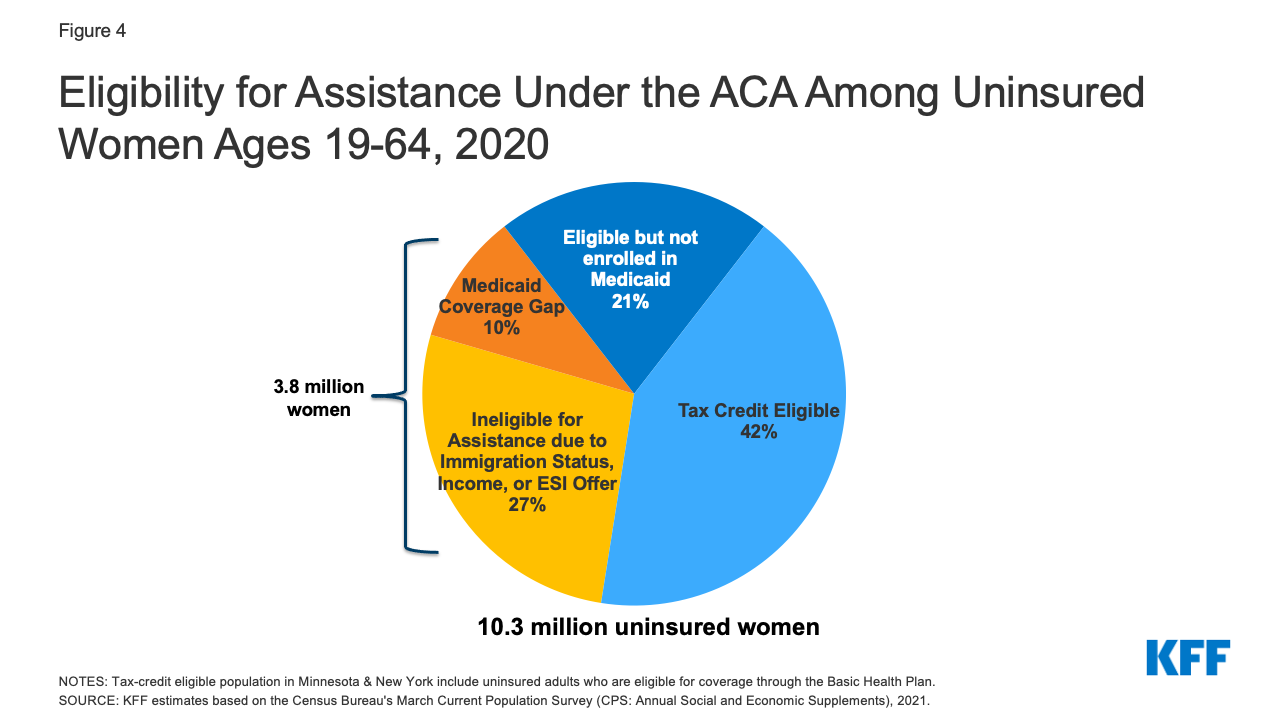

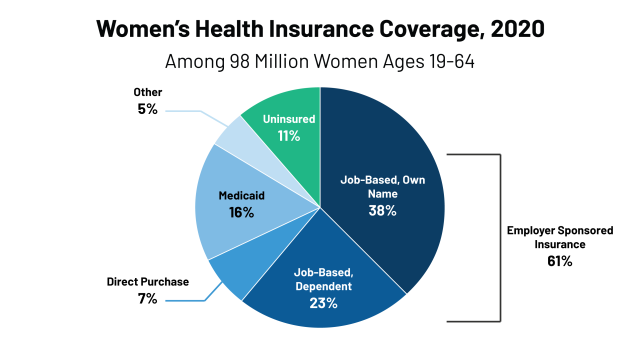

Women S Health Insurance Coverage Kff

189 of home value.

. Tax Year 2020 Personal Income Tax - VT Rate Schedules. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax.

Discover Helpful Information And Resources On Taxes From AARP. Vermont Income Tax Rate 2020 - 2021. These back taxes forms can not longer be e-Filed.

Tax amount varies by county. How to Calculate 2020 Vermont State Income Tax by Using State Income Tax Table. RateSched-2020pdf 11722 KB File Format.

Tax Year 2021 Personal Income Tax - VT Rate Schedules. Check the 2020 Vermont state tax rate and the rules to calculate state income tax. Vermonts rate schedules are designed to maintain at least 15 years of funding if no additional taxes are paid.

Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875. Tax Rate Schedules 2020 and After Returns Tax Rate Schedules 2018 and 2019 Tax Rate Schedules 2017 and Prior Returns You must use the New Jersey Tax Rate Schedules if. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

THE TAX SCHEDULES AND RATES ARE AS FOLLOWS. Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. Find your income exemptions.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Below are forms for prior Tax Years starting with 2020. Find your gross income.

When using the tax table use the correct column. Vermont Tax Brackets for Tax Year 2020. Monday February 8 2021 - 1200.

Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Details on how to only prepare and print a Vermont 2021 Tax Return. Please understand though that other governing authorities such as Middlesex County and the school board determine their own tax.

Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. If your New Jersey taxable income is less than 100000 you can use the New Jersey Tax Table or New Jersey Rate Schedules. Vermont also has a 600 percent to 85 percent corporate income tax rate.

Find your pretax deductions including 401K flexible account contributions. The Vermont tax rate is unchanged from last year however the. Tax Rate Class.

Integrate Vertex seamlessly to the systems you already use. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. 312 a applicable to the states.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Subtract 75000 from 82000. Vermont State Income Tax Forms for Tax Year 2021 Jan.

The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered in 2018 by 128 percent. Your 2021 Tax Bracket To See Whats Been Adjusted. There are -855 days left until Tax Day on April 16th 2020.

As you can see your Vermont income is taxed at different rates within the given tax brackets. Ad Compare Your 2022 Tax Bracket vs.

Vermont Income Tax Brackets 2020

Women S Health Insurance Coverage Kff

Top 10 Scams Of 2020 Released By Attorney General Vermont Business Magazine

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Calculator Smartasset

What Are Estate And Gift Taxes And How Do They Work

Total Alcohol Consumption Per Capita By U S State 2020 Statista

State Payroll Taxes Guide For 2020 Article

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design

Star Studded Line Up On Judging Panel Announced For Wirex And The Fintech Times Rising Women In Cr Fintech Forex Trading Tips Cryptocurrency Trading

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Tax Foundation On Twitter South Dakota Inbound Map

Taxes 2020 These Are The States With The Highest And Lowest Taxes

Maine Skyline Portland Head Lighthouse Print Maine Wall Art Maine Print Portland Head Maine Wall Art Loose Petals Art Style E8 O Mai

Taxes 2020 These Are The States With The Highest And Lowest Taxes

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

State Corporate Income Tax Rates And Brackets Tax Foundation